Table of Content

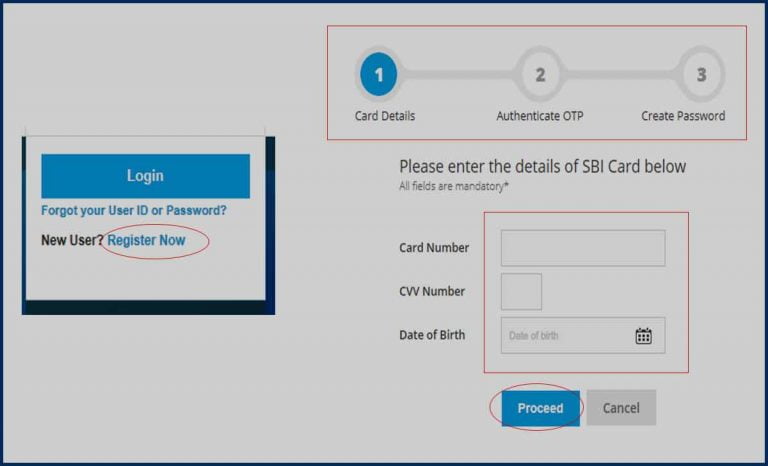

It is the responsibility of the User to comply with any regulations prevailing in the country from where he/she is accessing the Internet. The User needs to get his PCs/laptops/tablets/mobiles scanned on a regular basis and have these updated with the latest antivirus software available. The Bank shall not be responsible in case of any data loss or theft due to any virus transmitted in the system through the usage of SBI Apply Online. The Bank has adopted the mode of authentication of the User by means of verification of the User ID and or through verification of password or through any other mode of verification as may be stipulated at the discretion of the Bank. The User hereby agrees/consents for the mode of verification adopted by the Bank.

'Quote' / 'Eligibility' refers to an applicant's eligibility under the particular loan scheme. The quote shown to an applicant depends upon inputs provided by the online applicant. Request you to write to us at sbicard.com/email with the details of your concern. You can access your SBI Credit Card account instantly on your Android device. Just download this app and log in using your SBI Credit Card Online User Id & Password to manage your card account on your fingertips. Identify the areas which pull down your credit score and continuously work on them in order to improve your score gradually.

These SBI credit cards will revise their reward point policies from January 2023; know in detail

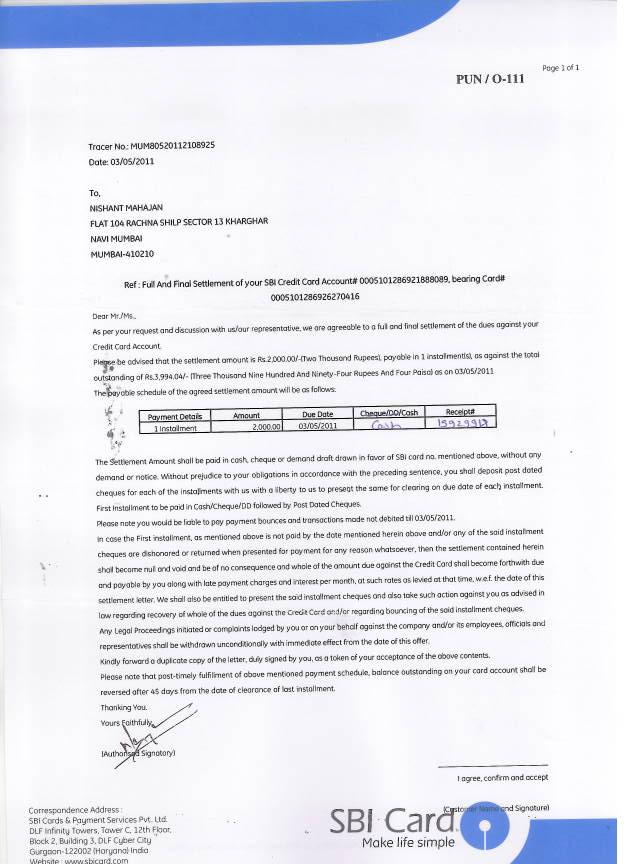

The validity period of such "Approval in Principle" would be 45 days from the issuance of the letter. Final sanction of the loan application will depend on satisfactory KYC, Income, credit worthiness and documents verification. The applicant will also have to provide Collateral Security and Third Party Guarantee for sufficient value, wherever applicable. Thereafter, if you are also a customer of SBI Card and own the aforementioned credit cards, visit the official website to see how your credit card usage will be impacted. Transfer outstanding balances of your other credit cards to TATA Card and pay back in EMIs. Pending We are currently not able to ascertain the status of your transaction from your Bank.

Credit score is a numerical expression that establishes your credibility as a borrower. It indicates the probability of default by a consumer on the basis of his or her repayment performance in the past 12 months and is an important factor that determines whether a lending institution will approve your loan or credit applications or not. Higher the credit score, higher is the probability that banks and other lending institutions will approve your loan or credit card application. This is one of the most important requisites for a sound credit score. Your credit history plays a very important role in banks and lending institutions to decide whether you should be given more credit.

SOFTWARE COMPATIBILITY

In case of any issues with bank settlement or network failure, we request you to wait for 24 to 48 hours to get the credit. Please ensure to enter your active credit card number for instant credit of your payments. Any delay or failure of this kind will not be deemed to be a breach of the Terms of Service (Terms & Conditions) and the time for performance of the af-fected obligation will be extended by a period which is reasonable in the circumstances. The User acknowledges that the software underlying the SBI Apply Online service as well as other Internet related software which are required for accessing SBI Apply Online service is the legal proper-ty of the Bank/the respective service providers. The permission given by the Bank to access SBI Apply Online service will not convey any proprietary or ownership rights in the above software. The User shall not attempt to modify, translate, disassemble, decompile or reverse engineer the software underlying the SBI Apply Online services nor create any derivative product based on the software.

"Upload Document" functionality is provided for expediting the loan process. The Bank may ask for original and/or photo copy of such document for verification and/or at the time of processing of loan application. Bank will not use such document for any other purpose like updating KYC details, etc. Click here for a detailed account on dos and don’ts related to the safety of your credit cards.

Mutual Fund

Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time. SBI Card will validate the Credit Card number entered by you and post the credit to your card within 2 working days. Corporate Banking application to administer and manage non personal accounts online.

Always log in into your credit card account from a secure computer that is malware free. Make a strong password(combination of Upper case, numbers & special characters) for the online account of your credit card and do not share your password with anyone. In case, if your score is less than what is generally considered by your lending institutions, take necessary measures to improve the score. Make a strong password for the online account of your credit card and do not share your password with anyone.

Availability of SBI Apply Online service

To come back to the question of risks, good practice suggests that the users should evaluate risks, appreciate and balance the criticalities and the convenience which Apply Online offers. SBI has put in place secure and effective systems to mitigate the risks from the Bank's end. We seek a little effort from your side, in maintaining this as a safe and secure channel.

When you shop, make sure you have collected your card at the end of the transaction. Also, before signing the charge slip, check the amount printed on it. Please make the payment only to the extent of outstanding on your credit card. Any payment made above the outstanding on your card , will be at the Bank discretion to accept or reject. Have you tried our new simplified and intuitive business banking platform? When you shop, make sure that the card is not out of your sight and you have collected your card at the end of the transaction.

'Applicant' refers to an applicant named in the Application Form and shall, where the context requires, include Co-applicant with the Applicant. With the network of 16,000 plus branches it cover more than 1.01 Crore users. You are about to access a site, the accuracy or completeness of the materials or the reliability of any advice, opinion, statement or other information displayed or distributed through it, is not warranted by SBICPSL and shall be solely be construed to be set forth by the third party. Credit cards give you a lot of power and if you follow some crucial mantras about their usage, you can harness them well.

SBI Apply Online is an alternate channel for our customers, and provides the facility of applying for most of the retail loan products available at our branches. Retail loan products such as Home Loan, Auto Loan, Education Loan and Personal Loan can be applied for through this service. When you apply for a loan or credit card, the lending/issuing company checks your credit score first to determine if you are eligible to avail the loan or get a credit card.